In 2025, China's encoder magnetic rings have achieved significant advancements, leading the world in cost-effectiveness. Many foreign researchers underestimate that China's robust robotics, automotive, and quadruped robot manufacturing prowess is underpinned by a complete and highly cost-effective magnetic encoder supply chain.

1. Initial Stage (1980s-1990s)

- Background: During China's reform and opening-up period, industrial automation began to emerge, with encoders primarily imported (e.g., Japanese and German brands). State-funded initiatives like the Torch Program (1988) provided early research grants, though focused on low-end applications.

- Magnetic Ring Technology:

- Early magnetic rings were simple magnetized loops used in incremental encoders, offering low precision (typically <1,000 PPR).

- Ferrite was the dominant material, with limited temperature resistance and EMI immunity. The 1995 Nine-Five Plan explicitly identified encoders as strategic components for CNC machines.

- Localization Efforts: A few research institutes (e.g., Chinese Academy of Sciences, Harbin Institute of Technology) began studying magnetic materials for encoders, but industrialization remained limited. Changchun Institute of Optics' 1998 prototype achieved ±0.3° accuracy - China's first documented breakthrough.

2. Technology Introduction & Imitation (Early 2000s)

- Market Driver: Growing demand for CNC machines and servo motors spurred domestic encoder production. Post-WTO accession (2001) saw CNC machine output grow at 20% CAGR, accelerating localization needs.

- Technological Breakthroughs:

- Imported magnetic ring manufacturing equipment (e.g., magnetizing encoders) enabled mid-to-low-end production.

- Adoption of NdFeB and other rare-earth materials enhanced magnetic signal strength. The 2012 National Technology Invention Award recognized Changchun IOE's >16-bit resolution breakthrough.

- Key Players:

- Changchun Institute of Optics and Shanghai WinDouble entered magnetic encoder R&D.

- Foreign companies (e.g., Tamagawa, Heidenhain) established local factories, boosting supply chains.

3. Independent Innovation (2010s–Present)

- Advancements:

- High-Precision Rings: Resolution reached 18+ bits (for absolute encoders) via multi-pole magnetization. CASIC's 33rd Institute developed 100kGy radiation-proof rings for BeiDou-3 satellites (2021).

- Material Upgrades: High-temperature rare-earth magnets (e.g., SmCo), corrosion-resistant polymer composites.

- Integrated Design: Magnetic rings paired with ASICs for signal processing (e.g., magnetoelectric encoders). Made in China 2025 (2015) designated encoders as core components, triggering $150M+ cluster investments.

- Applications:

- EV motors, robotic joints, wind turbine pitch systems.

- Harsh environments (–40°C to 150°C, high vibration). Post-2020 Huawei sanctions drove Inovance to achieve 90%+ servo encoder localization.

- Localization:

- Huawei, Inovance pushed supply chain independence.

- Specialized manufacturers emerged in Jiangsu and Guangdong.

4. Current Mainstream Magnetic Ring Technologies

Ferrite Magnetic Rings

Dual-Track Encoder Ring

- Resolution:

- Incremental encoders: 500–5,000 PPR (±0.1° to ±0.02°).

- Absolute encoders: 12–16 bits (4,096–65,536 CPR) Inovance co-authored IEC 61800-7 (2021) durability standards - China's first encoder-related IEC leadership.

- Limitation: Low permeability restricts resolutions >18 bits.

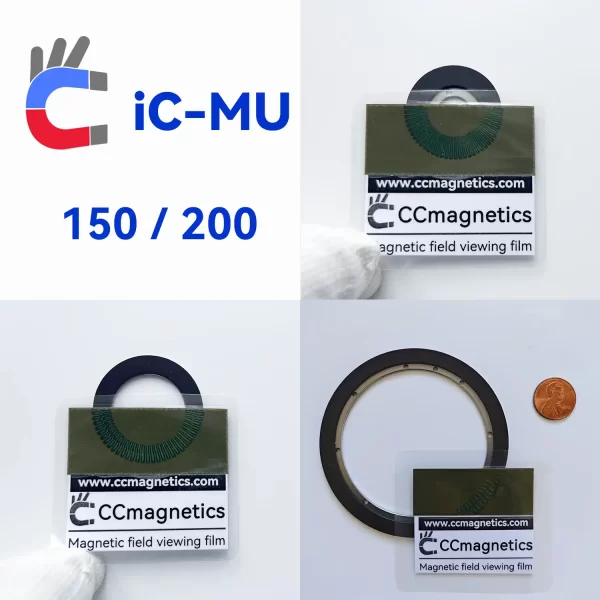

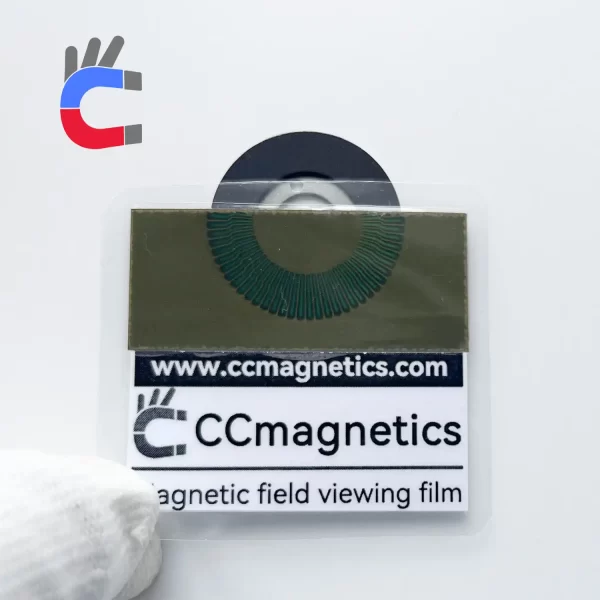

Rubber Magnetic Rings

Encoder targets

- Resolution:

- Standard: 100–1,000 PPR (flexible, low-cost applications).

- Anisotropic rubber: Up to 2,000 PPR (less stable than sintered magnets).

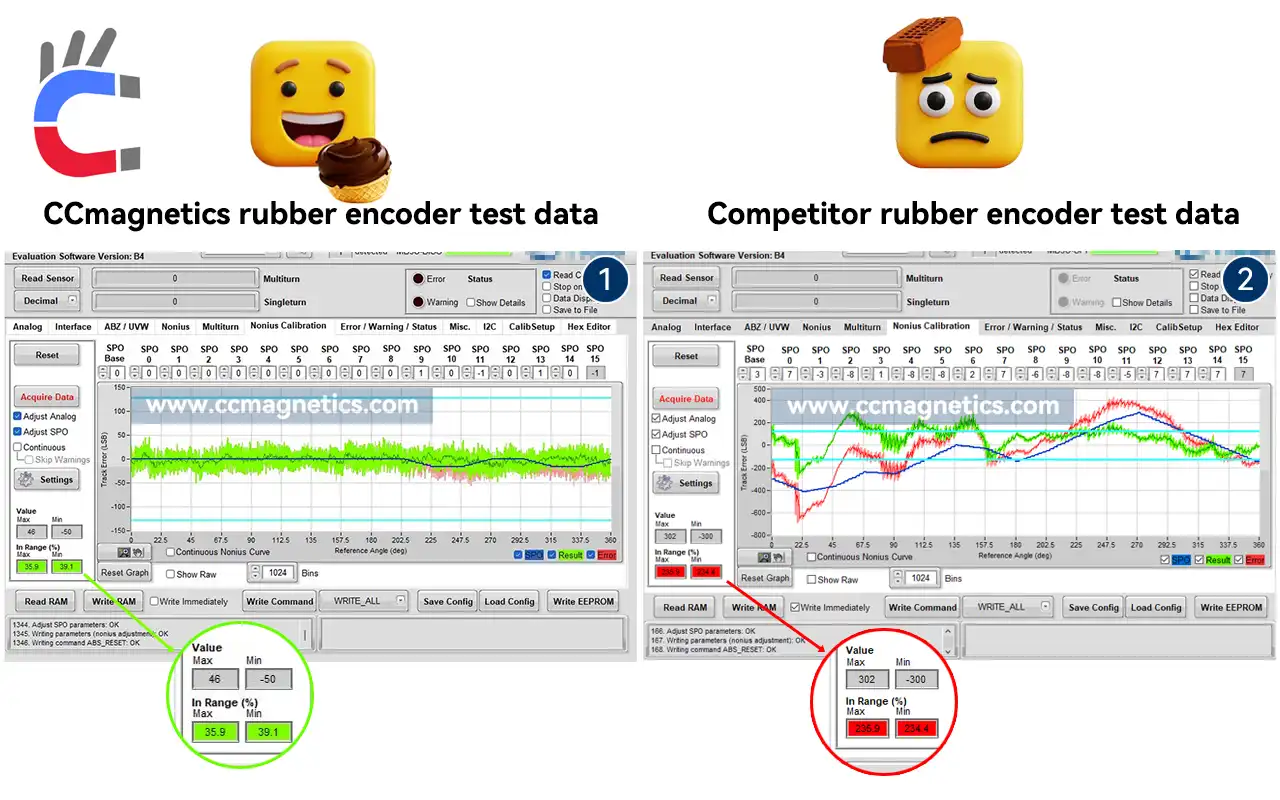

- Cutting-edge: Composite materials achieve 19-bit (524,288 CPR). Chinese firms now hold 12% of IEC/ISO working group seats vs. 1% in 2010.

5. Challenges & Future Trends

- Challenges:

- Ultra-high precision (>22 bits) still relies on imports (e.g., Mitsubishi).

- EMI resistance needs improvement. Core testing protocols remain under German/Japanese control.

- Trends:

- AI Integration: Compensate for signal errors algorithmically.

- Ringless Tech: Competition from optical/inductive encoders.

- Standardization: China's encoder standards (e.g., GB/T 36690-2018).

Key Players & Innovations

| Company | Technology | Applications |

|---|---|---|

| CCmagnetics | 19-bit multi-pole rings | Industrial robots, CNC |

| Shenzhen Aolit | SmCo rings (≤150°C) | EV motors |

| Changchun IOE | Space-grade anti-radiation encoders | Satellites, aerospace |

| <> CASIC 33rd Inst | 100kGy radiation-proof rings | BeiDou navigation system |

Why This Matters for Global Engineers

China's encoder magnetic rings now rival mid-tier international products, offering cost-effective alternatives for automation, EVs, and robotics. While gaps remain in ultra-high precision, breakthroughs in materials and AI-driven calibration are closing them fast. From reverse-engineering in the 2000s to IEC standard co-authoring today, China's encoder evolution reflects its broader industrial ascent - state-backed, crisis-accelerated, yet still confronting high-end barriers.